News

Optimism in Banking Performance Amid Expectations of Macroeconomic Stability - OJK Banking Business Orientation Survey for Q1-2025

Jakarta, 3 March 2025. OJK Chief Executive of Banking Supervision, Dian Ediana Rae, stated that the OJK Banking Business Orientation Survey (SBPO) for Q1-2025 indicates that respondents are optimistic that banking performance will continue to improve. The survey involved 96 respondent banks, which accounted for 96.61 percent of the total assets of commercial banks based on December 2024 data.

Banking optimism is reflected in Banking Business Orientation Index (Indeks Orientasi Bisnis Perbankan/IBP) for Q1-2025, which was recorded at 60 (optimistic zone). This optimism is driven by expectations of macroeconomic stability, as well as the continued improvement in intermediation, along with the banking sector’s ability to manage the risks faced, despite the less favourable global macroeconomic conditions.

Confidence in the stability of domestic macroeconomic conditions has resulted in the Macroeconomic Condition Expectation Index (IKM) for Q1-2025 reaching an optimistic level of 53, primarily due to expectations of stable domestic macroeconomic conditions and a projected downward trend in the BI-Rate. In line with this macroeconomic outlook, GDP is expected to continue growing, driven by an anticipated increase in public consumption in response to the Ramadan and Eid al-Fitr period in Q1-2025, the increase in the 2025 Provincial Minimum Wage (Upah Minimum Provinsi/UMP), and the implementation of the 2025 economic stimulus.

Furthermore, the majority of respondents also believe that banking risks in Q1-2025 remain controlled and manageable. This is reflected in the Risk Perception Index (Indeks Persepsi Risiko/IPR), which stood at 55, indicating confidence that risks are adequately managed, in line with the belief that credit risk and market risk remain stable. Respondents are confident that credit quality remains sound, Net Open Position (NOP) remains low with foreign currency assets and receivables exceeding foreign currency liabilities (long position), and profitability will continue to increase in line with credit distribution growth. Additionally, liquidity risk is also expected to remain stable compared to the previous quarter.

Expectations regarding banking performance in Q1-2025 also remain optimistic, with Performance Expectation Index (Indeks Ekspektasi Kinerja/IEK) standing at 74. Optimism about credit growth in Q1-2025 is driven by expectations of continued domestic economic growth and the momentum of Ramadan and Eid al-Fitr, which are expected to boost credit demand and business activity. On the funding side, respondents predict that in Q1-2025, Third-Party Funds/Deposits (Dana Pihak Ketiga/DPK) will also continue to grow in line with improving economic activity and banks’ efforts to secure funding sources to support credit growth.

Through SBPO, OJK also gathers information on the global and Indonesian economic outlook for 2025. Based on SBPO results, global economic growth is expected to slow down. This is driven by uncertainties in global conditions, amid persistently high geopolitical tensions and the potential for trade wars.

Meanwhile, Indonesia’s economy in 2025 is projected by respondents to grow at a stable rate. This projection is supported by the decline in the benchmark interest rate, pro-growth government economic policies, the end of the "wait-and-see" stance by investors who are expected to resume investments after the 2024 political year, and controlled inflation expectations.

SBPO

OJK conducts SBPO on a quarterly basis to obtain an overview of the banking industry’s perspective on economic direction, perceptions of banking risks, and the outlook/trends of the banking business for the upcoming quarter. SBPO produces Banking Business Orientation Index (IBP), a composite index that reflects perceptions on a scale of 1 to 100, where an index >50 indicates an optimistic perception, an index =50 indicates a stable perception, and an index <50 indicates a pessimistic perception. The IBP consists of three sub-indices: the Macroeconomic Condition Expectation Index (IKM), the Risk Perception Index (IPR), and the Performance Expectation Index (IEK).

In addition to these three indices, SBPO also provides other relevant information regarding current issues in the banking industry and factors that are considered to influence banking performance.

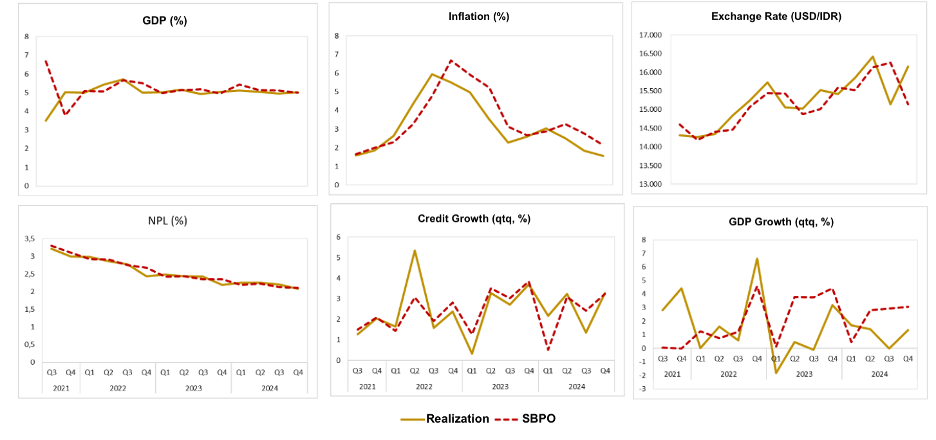

Historically, SBPO survey results have been relatively accurate in predicting trends in various macroeconomic and banking indicators in Indonesia.

Comparison Between SBPO Projection Figures and Actual Outcomes

Click here for full report on the results of the Q1-2025 SBPO